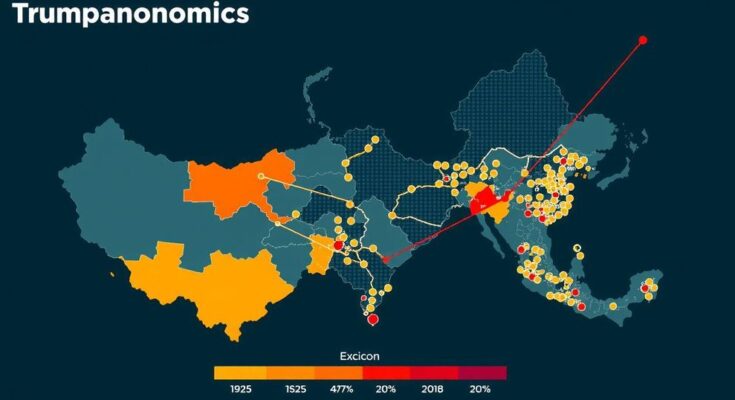

With Donald Trump’s election victory, global economies are bracing for significant changes in trade, capital flows, and labor markets. The potential shift toward isolationist policies poses risks for China, Europe, and Mexico, prompting leaders to analyze these consequences critically. Amidst this uncertainty, financial markets show an odd calm, setting the stage for a turbulent economic future.

In the aftermath of Donald Trump’s election victory, a sense of unease blankets global economies. Trump’s unconventional approach to economics and negotiations is set to transform trade systems, capital flows, and labor markets. Leaders and analysts worldwide are engrossed in deciphering what this shift means not only for America but also for critical players like China, Europe, and Mexico, who stand at the forefront of potential fallout from ‘Trumponomics’. The geopolitical landscape is charged; strategic alliances are under scrutiny as Trump’s administration promises to alter longstanding trade agreements. As the clock ticks closer to policy implementation, nations fear the repercussions of the U.S. adopting a more isolationist stance. This shift could lead to significant economic turbulence, especially for countries heavily reliant on exports to America. Meanwhile, financial markets display a curious calm, a facade belying the storm brewing under the surface. Observers speculate how a robust dollar could unsettle global currencies, as economic confidence teeters on the brink of uncertainty. The financial world watches, holding its breath for the first tremors of impending change, and how that may reshape the world economy amidst the looming shadows of protectionist policies.

Trump’s election heralds a significant pivot in U.S. economic policy, moving toward protectionism and isolationism. His administration’s plans could redefine international economic relations, particularly with global powerhouses like China and trade partners in Europe and Mexico. Analysts are keenly assessing the implications of these shifts, recognizing that such changes could have far-reaching consequences for economies already grappling with uncertainty.

The global economy stands at a precipice as Trump’s administration prepares to implement transformative policies. Nations like China, Europe, and Mexico brace for the economic winds of change, anticipating the disruption of trade and investment flows. With each decision made, the ripple effects on international relations and financial markets will unfold, creating a landscape more volatile than ever. The world watches closely, aware that the stakes have never been higher.

Original Source: www.economist.com