Economists predict inflation could spike under a second Trump presidency, with 68% asserting it would rise faster than under Kamala Harris. Trump’s proposed tariffs, aimed at protecting American jobs, may result in higher consumer prices and significant job losses, challenging the narrative he promotes in his attacks against Harris and Biden.

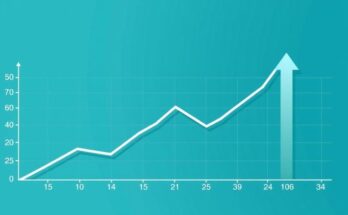

In the ever-evolving realm of American politics, inflation has emerged as a prominent subject, drawing sharp divisions between political figures and their economic ideologies. Donald Trump has become an ardent critic, pointing fingers at Kamala Harris and President Joe Biden, blaming them for the inflationary surge witnessed in the wake of the COVID-19 pandemic. His criticism holds political weight, especially with voters clearly anxious about financial strains as they prepare to cast their votes in November. However, a recent survey conducted by the Wall Street Journal reveals an intriguing twist: a majority of economists predict that inflation could escalate even further under a second Trump presidency compared to Harris’s leadership. In this survey, engaging 50 economists from various sectors, a staggering 68% believe inflation would be more rampant under Trump, a spike from just 56% in July. Conversely, only 12% forecast higher prices under the Democrats, while 20% assert that the election’s outcome may not materially impact inflation rates. This apprehension among economists regarding Trump’s potential presidency stems largely from his aggressive tariff policies. A return to the protectionist measures he previously championed is feared to exacerbate economic strains. Trump has proposed steep tariffs: a sweeping 20% on imported goods globally and a daunting 60% targeted at Chinese products. Dan Hamilton, director of economic research at California Lutheran University, articulated this notion, stating, “Since July, it became apparent to us that Trump is even more anti-free-trade than Harris.” Both parties have adopted a populist veneer concerning import taxes, obscuring the reality of these tariffs. Notably, tariffs function as a tax on consumers, as businesses typically transfer additional costs associated with tariffs onto their customers. The repercussions of Trump’s initial trade war during his first term saw American taxpayers bearing nearly $80 billion in new taxes, according to the Tax Foundation. Further analyses from Federal Reserve economists indicated that the tariffs imposed from 2018 to 2019 led to a decline in employment and output, overshadowing any protective benefits for domestic industries. Interestingly, the Biden administration continued with many of Trump’s tariffs, opting for tariff hikes on an additional $18 billion worth of Chinese goods. Overall, the Tax Foundation claims the combined economic effect of the Trump and Biden tariffs might cause a long-run reduction in GDP by 0.2%, potentially eliminating about 142,000 jobs. The foundation also forecasts that Trump’s proposed tariff increases could lead to a further GDP shrinkage of at least 0.8%, resulting in the loss of an alarming 684,000 jobs in the process. These estimates do not even account for probable retaliatory actions from trading partners. While inflation appears to have cooled down from record highs experienced during Biden’s initial term, edging toward the Federal Reserve’s target of 2%, the political landscape remains volatile, particularly as the central bank has begun cutting interest rates for the first time since the pandemic’s outbreak.

The political landscape of inflation in the United States has gained importance in light of the COVID-19 pandemic and subsequent economic challenges. Donald Trump has frequently used inflation as a political tool, assigning blame to his opponents for rising prices, particularly focusing on Vice President Kamala Harris and President Joe Biden. Despite his assertions, economic experts have noticed a pivot, indicating that inflation could worsen under Trump’s policies compared to those of Harris. The narrative around tariffs, especially from Trump’s previous presidency, intertwines deeply with these economic predictions, affecting consumer prices significantly and impacting employment rates.

In summary, while Trump vocally criticizes his political opponents regarding inflation, a significant number of economists project that a second Trump presidency could result in even higher inflation rates due to his proposed protective tariffs. The ongoing debate about the impact of tariffs highlights the interconnectedness of trade policies and their effects on American consumers and employment. As we head toward the election, the economic implications weigh heavily on the minds of voters.

Original Source: fortune.com